Suzano + Pulp and Paper Primer

The Brazilian hardwood pulp leader at a cyclical cross roads

Suzano is a synonym of Brazilian pulp.

The company literally founded the first paper factory in Brazil to replace imports during WWII, and carried out the R&D that enabled the production of paper from 100% eucalyptus pulp, without which today Brazil would not command the top global cost position in the paper pulp market.

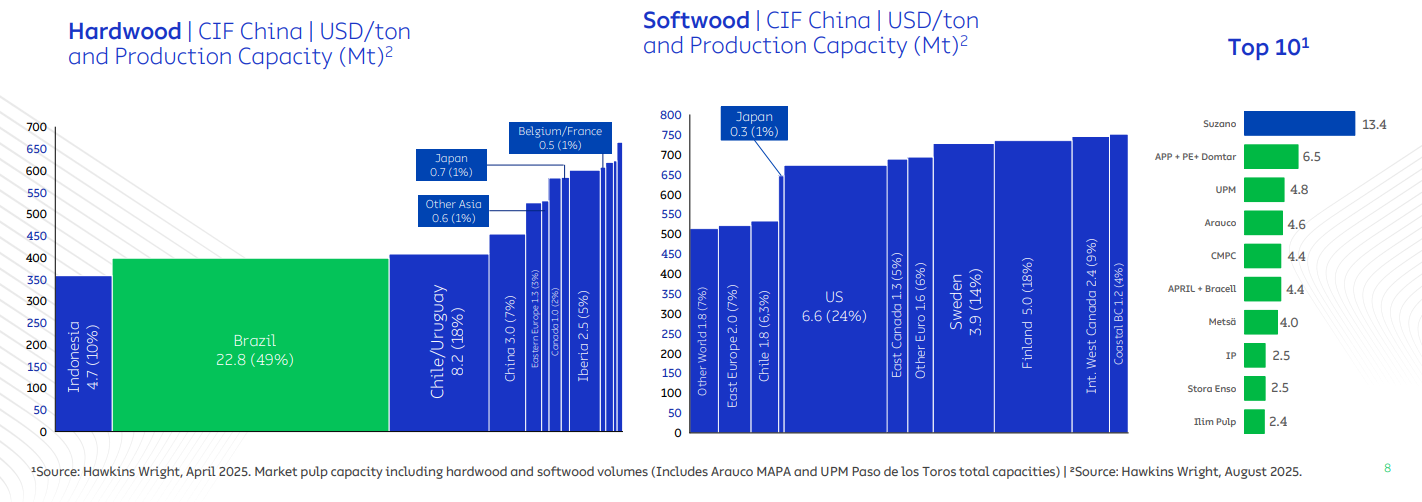

After a series of mergers, the company today commands a large, cost-leadership position in the hardwood pulp market. Not only does it sit at the global bottom of the cost curve, but produces ~30% of global market hardwood pulp and 50% of the Brazilian market hardwood pulp.

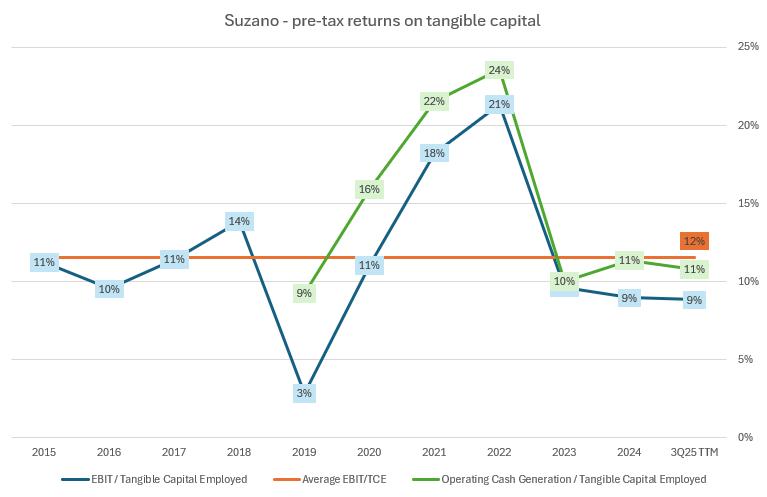

This dominant position has allowed the company to command a reasonable pre-tax return on tangible capital employed, with good downside protection during cyclical downturns.

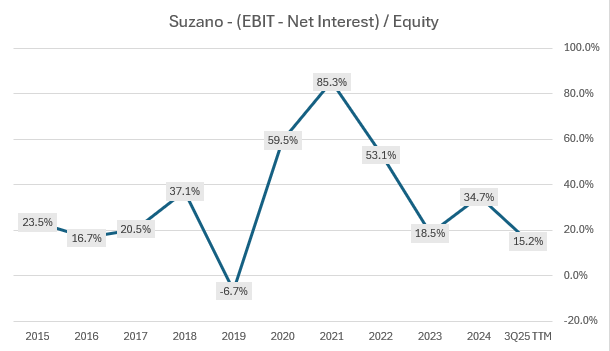

To the relatively good returns on capital, we have to add a key additional advantage: Suzano can issue investment-grade debt (BBB-, lowest tier) in foreign currency. Being an exporter, it can finance in USD at much cheaper rates than in BRL, without adding currency risk.

Good operating returns on capital and cheap(er) leverage allow for leverageable returns on equity.

Opportunity and risks

The potential for opportunity stems from the fact that pulp and paper are markets under cyclical pressure from the usual suspects: Chinese overcapacity eating into domestic and foreign demand, the promise of additional capacity in the 2026-2029 range, and the risks of more muted demand growth going forward.

To this, we need to add intrinsic factors, like the ramp-up of production in a large CAPEX project (Cerrado project) coinciding with the cyclical downturn, and a strategic shift into downstream integration (JV with Kimberly-Clark).

The opportunity requires careful analysis, and this article provides that. It starts by explaining the industry, its cyclical drivers, current cyclical position, and forward demand/supply dynamics. Then, it analyzes Suzano’s asset structure, balance sheet, and capital allocation perspectives.

In total, this is a 6,000-word article that can provide a working thesis for understanding Suzano’s position, opportunities, and risks. In addition, a 6,000-word Annex double-clicks on specific cyclical and accounting factors, which I have not seen covered in detail in other reports on the company or the industry.

Index

Pulp and paper industry basics

Downstream paper demand

Paper & pulp integration

Types of pulp fiber

Cost curves and forestry factors

Foreign trade dynamics

Current cycle dynamics

China

Europe and North America

Latin America

Impacts on cost curves and clearing prices for wood

Suzano’s pulp business

Pulp leadership

Sources of competitive position

Exposure to FX

Margins across the cycle

Suzano’s downstream business

Capital allocation focus

Analyzing the Kimberly-Clark JV deal

Valuation from a capital returns perspective

Profitability under cyclical downturn conditions

Uses of capital

Annex section: a deeper dive into specific factors in the cycle, modelling, and accounting

Cyclical factors double-click

Chinese wood availability

Brazilian wood availability

Fiber to fiber and disintegration trends

Pulp price reporting

Accounting & modelling

biological assets

hedge accounting

BRL accounting

adequate capital return metrics

net debt costs

taxes

Kimberly-Clark JV financials.

1 - Pulp and paper basics

The chart above shows a fairly complete schematic of the global paper market, from downstream uses on the left to upstream sources on the right. Paper is made from cellulose pulp, which itself is obtained from trees (virgin pulp) or recycled from old paper. There are two types of virgin pulp, softwood and hardwood, each obtained from different species of trees, and supporting different paper applications.

a - Downstream paper demand

Although paper seems like an outdated concept in our digitalized existence, it is still a growing market that underpins the modern economy, from everyday logistics to having clean buttocks.

The majority of paper demand and growth comes from packaging, including cardboard, which is considered a form of paper. Packaging is GDP-driven and is enjoying e-commerce and sustainability tailwinds. The majority of packaging is produced using recycled pulp, over which we don’t concern ourselves in this article that much, but it also generates growing demand for virgin pulp.

The larger virgin market is Printing & Writing, including stationery, books, and newsprint. Because of digitalization, this market is in secular decline almost everywhere in the world.

Next is tissue, including toilet paper, kitchen paper, and tissues proper. It is a mature industry in developed economies, but grows above GDP in emerging ones.

Finally, we have specialty, which is a catch-all going from high-end papers (like wallpapers) to food products like grease-resistant paper or paper cups and cutlery.

In aggregate, particularly in the developed world, this makes for a relatively mature market growing at ~ 1% to 2% per year. The sources of demand are mainly tissue and a percentage of packaging and cutlery that requires virgin fibers.

There are other specific markets not considered as part of the paper but that require cellulose pulps: dissolving pulps (used for viscose fabrics), and fluff pulps (used for diapers and other hygienic absorbents).

b - Paper & pulp integration

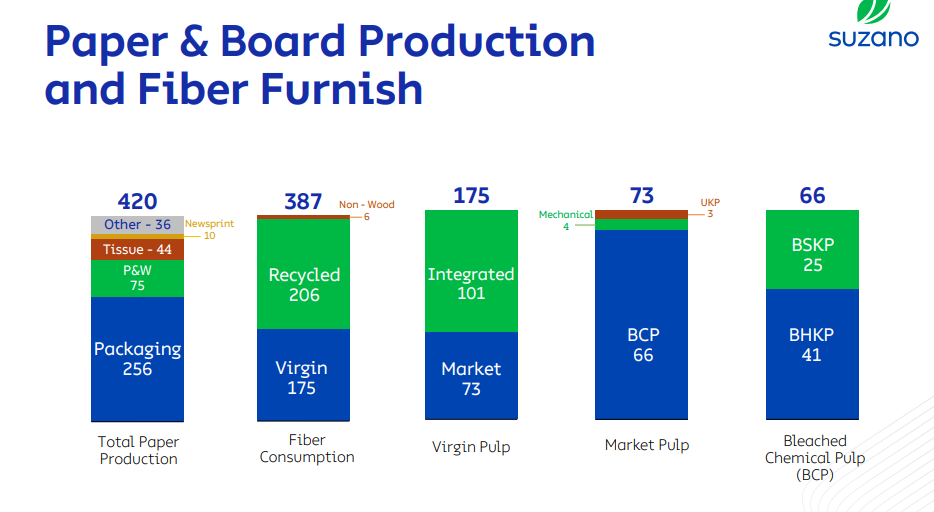

Within the paper market, we can distinguish between two types of paper producers: integrated and non-integrated.

Integrated producers produce their own pulp. Sometimes, they also own the forests from where the wood to produce the pulp is harvested. Integrated producers make up ~55% of the virgin market and the majority of the recycled market. Non-integrated producers purchase virgin pulp from the market and focus on paper production alone.

Because of logistics factors, integrated paper producers tend to be located in areas where forest resources are more plentiful. This includes Northern Europe, North America (both the US and Canada), China, Indonesia, and South America. In other countries, paper producers tend to purchase pulp from pulp exporting regions.

c - Types of fiber

Within pulps, we need to distinguish between softwood fibers (also called long-fiber, coniferous, or needle-leaf) and hardwood fibers (also called short-fiber, non-coniferous, or broad-leaf).

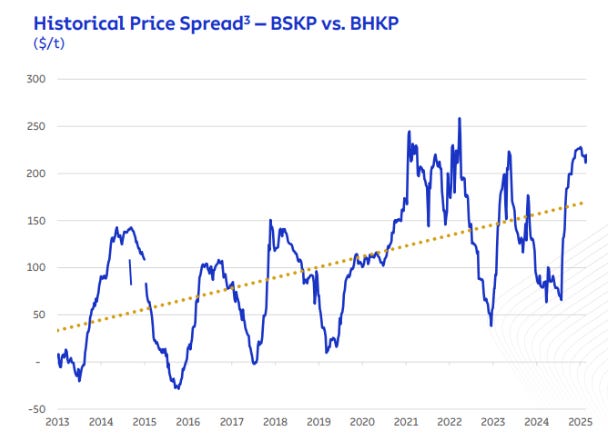

People refer to fibers by acronyms like BSKP (bleached softwood kraft pulp) vs BHKP (bleached hardwood…). To this, we can add even more details, like whether the pulp comes from the northern hemisphere (NBSK and NBHK) or the southern hemisphere (SBSK and SBHK), or even the species (like BEK for eucalyptus). What really matters is softwood vs hardwood; the rest is less important.

Softwood fibers come from coniferous species like pine, spruce, or fir. These fibers have higher strength, but are coarser and don’t absorb liquids well. The longer fibers also allow for better recyclability (given that with each round of recycling, the fibers get weaker). This makes softwood fibers a very important component of packaging demand. You want your boxes to be sturdy, to absorb little moisture/water, and to allow several recycling cycles.

Hardwood fibers come from deciduous (that is, falling leaves) varieties, of which the most important, by far, is eucalyptus. The short fibers allow for softer, brighter, and higher absorption products. Therefore, hardwoods are key for tissues, P&W, and coated specialties. Their disadvantage is a lack of strength.

Hardwoods are also historically cheaper than softwoods for several reasons. First, hardwoods are grown in more tropical regions, whereas softwoods require a more temperate or boreal climate. This makes hardwood more abundant than softwood. Second, hardwood requires less chemical treatment for processing. Finally, for historical reasons, softwood producers have older capacity (Europe, North America), with worse yields.

In real production today, fiber use is a mix of the natural properties of each fiber type, their relative price, and historical reasons. In North America and Europe, where softwood varieties are more common, mills originally produced almost entirely from softwood. Contrary to that, Suzano in Brazil developed 100% eucalyptus varieties of printing and tissue papers.

As a global pulp market emerged, and because eucalyptus hardwood is cost-competitive, mills have shifted to mixing softwood and hardwood in most uses. Today, hardwood makes up about 65/70% of the market-purchased pulp segment, but probably closer to 40/50% of the integrated pulp segment, with a significant skew to European and North American softwood integrated producers.

d - Cost curves and forestry factors

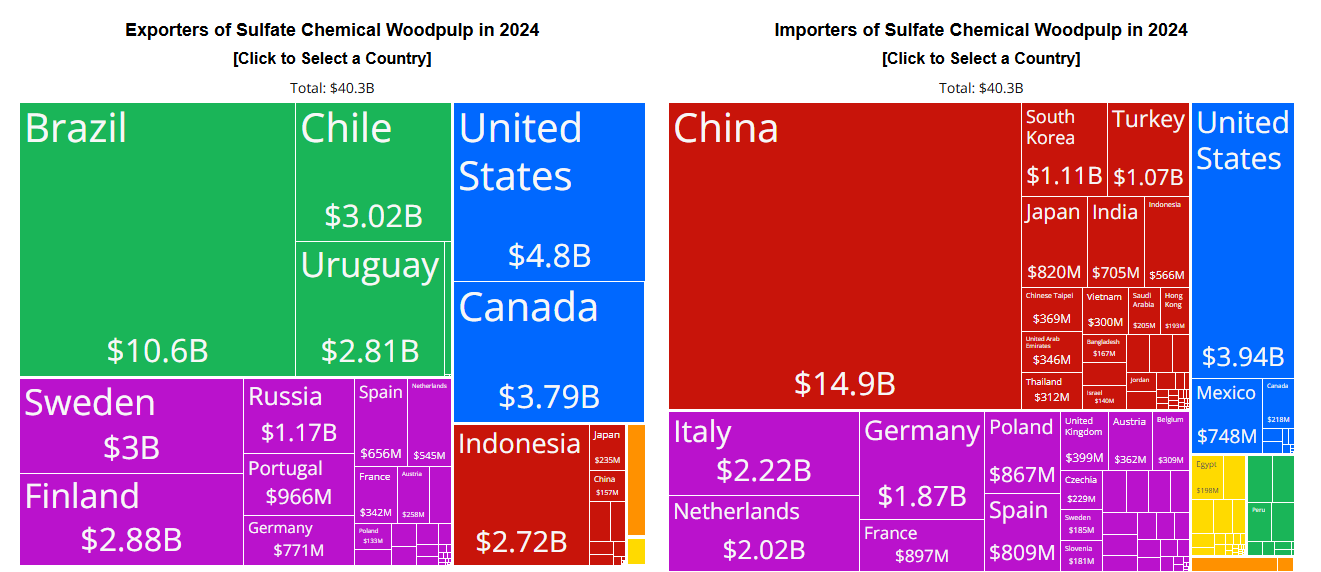

By far, independently of which cost curve is evaluated, Brazil is the cost leader in pulps, particularly in hardwood (eucalyptus), along with other southern cone markets (Chile and Uruguay).

The charts below show the market-segment cost curves for CIF China. As you can see, most of the hardwood curve is Brazilian and Chilean. South America is also a cost leader in softwood, but it has not developed that market as much because integration is higher in import markets.

The reason why Brazil is a cost leader is very simple: wood in Brazil grows very rapidly because of the appropriate climatic conditions. A forest in Brazil can grow at approximately 35m3/ha/yr, which is around 3x the average in China or Southern Europe, and 7/8x the average in Northern Europe and North America. Faster growth implies lower land requirements, lower labor costs, and lower risks.

Wood as a raw material makes up 50% of the cost of pulp. Indirectly, it makes up even more. For example, logistics can make up more than 20% of pulp CoGS, and logistics are highly affected by how distant the wood is from the mill. Lower productivity of land translates to a larger area needed to serve a mill, which translates to higher logistics costs. In addition, residue wood and components can fulfill most of the energy needs of an operation (80%+ in Suzano’s case, for example, inclusive of fuel and diesel consumption in the forestry operations). If your wood is cheap, your energy is cheap(er) as well.

This cost advantage opened a well of pulp production in South America, which became the globe's largest provider of market pulp to the expanding production in Asia (especially China) and to producers in Europe and North America trying to gain competitiveness by blending hardwood. Between 2008 and 2030, South American pulp production would have expanded from 15 million tons to 50 million tons, in the process flattening the hardwood cost curve significantly.

Note: In many reports (including Suzano’s), European or North American reported pulp prices are very different from those in China, up to 100% higher. This is not a real difference, but rather a reporting one (gross vs net). See the Annex for more details on this.

e - Foreign trade dynamics

Up until relatively recently, paper was not a particularly traded product category, particularly inter-continentally. Pulp, as we have seen, is primarily integrated into paper production (55% of paper production is pulp-integrated), albeit market pulp is obviously growing.

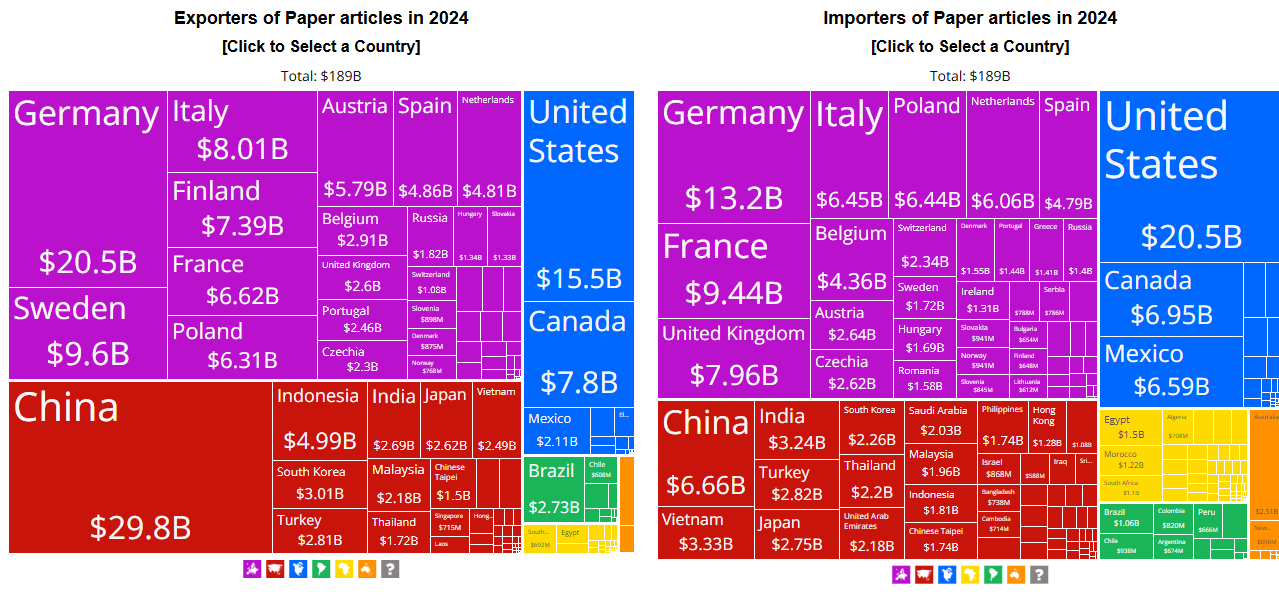

The global traded value of paper articles, excluding pulp and books, is ~$200 billion per year, and depending on estimates, the market size of paper is about $500/600 billion. If we net out intra-continental trade (Europe to Europe, Asia to Asia), the inter-regional trade is even lower as a percentage of the market.

Of course, there are net exporters, China and Northern Europe in particular, and net importers like the US, but even in those cases, it is mostly within the region. Based on my estimations, 75% of European exports occur within Europe. That same figure is 50% for Asia-Asia and 77% for NA-NA.

In pulp, the picture is a little different, with a larger share of market pulp (as we mentioned, about 40% of virgin pulp), most of which is traded inter-regionally (with LatAm as a big exporter and Asia as a big importer). Still, even in the case of pulp, integration (that is, same location consumption) represents ~55% of the market.

One of the reasons is again, logistics costs. We will see that Freight and SG&A in Suzano represent 1/3 of costs, similar to CAPEX or CoGS. LatAm can export inter-continentally because its CoGS is so much lower than the rest of the world that it remains competitive after adding transport.

The picture that emerges is one where paper is majoritarily produced within regions, and where pulp is also majoritarily locally produced, albeit with a significant portion of trade going from Latam to Asia (50% of Brazilian pulp exports, 80% of Chilean pulp exports), plus from Latam to Europe/North America (50% in the case of Brazil and Uruguay, 20% in the case of Chile).